Staking

« SWU » : token de l’energie

« SWU » : token de l’energie

Crypto-currency staking can be seen as a new-generation savings account. This process involves tying up a portion of your digital assets for a set period of time, with the aim of supporting a network's operations. This method is comparable to setting up a term savings account, where your funds are deposited for a certain period of time.

The reward? By actively participating in this mechanism, you benefit from additional gains, similar to the interest generated by a traditional savings account.

Staking: A Solution to Inflation?

In an economic climate where inflation can erode purchasing power, cryptocurrency staking is sometimes seen as a bulwark against this phenomenon. Why is this? It's all down to the deflationary nature of certain crypto-currencies, such as Bitcoin and SWU.

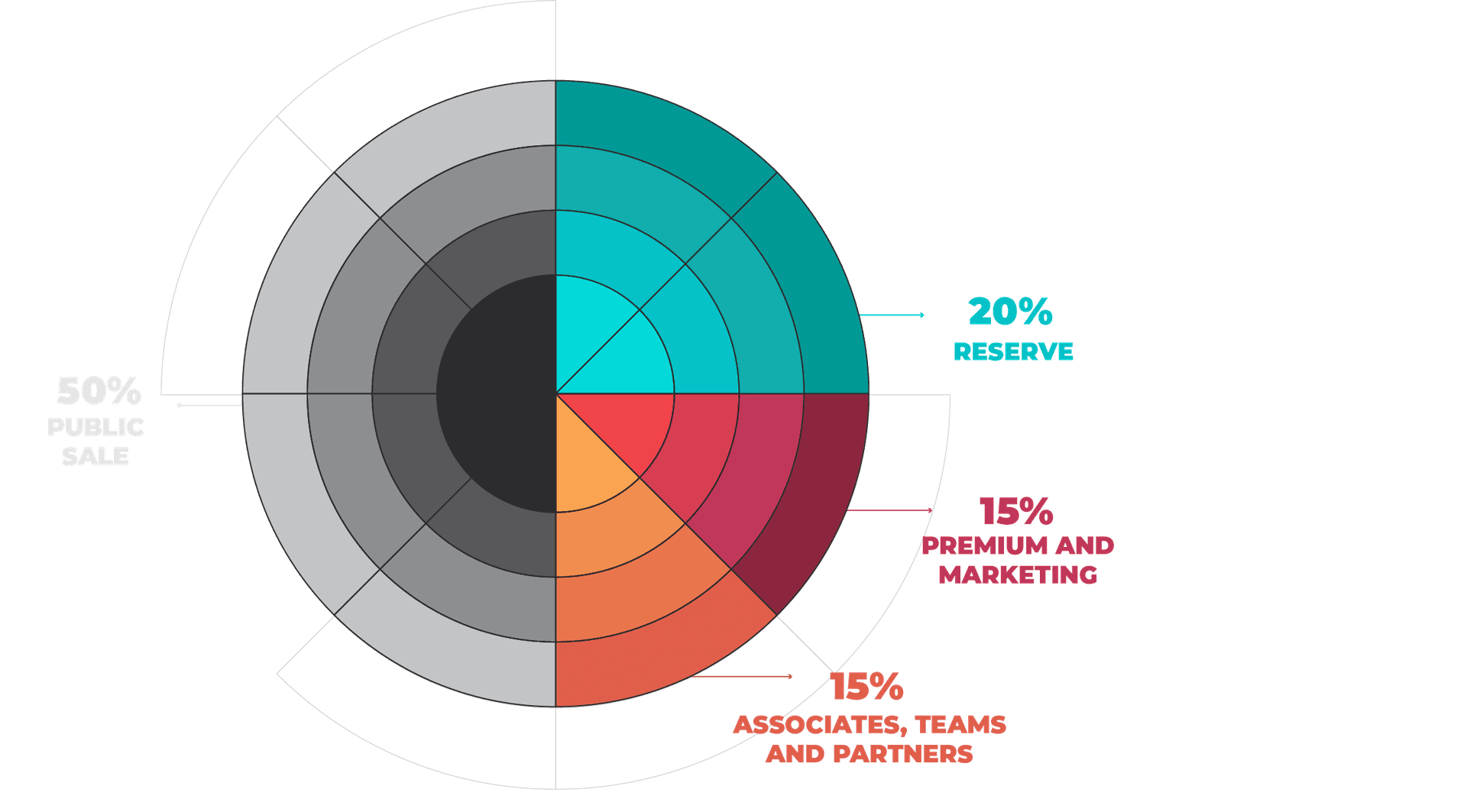

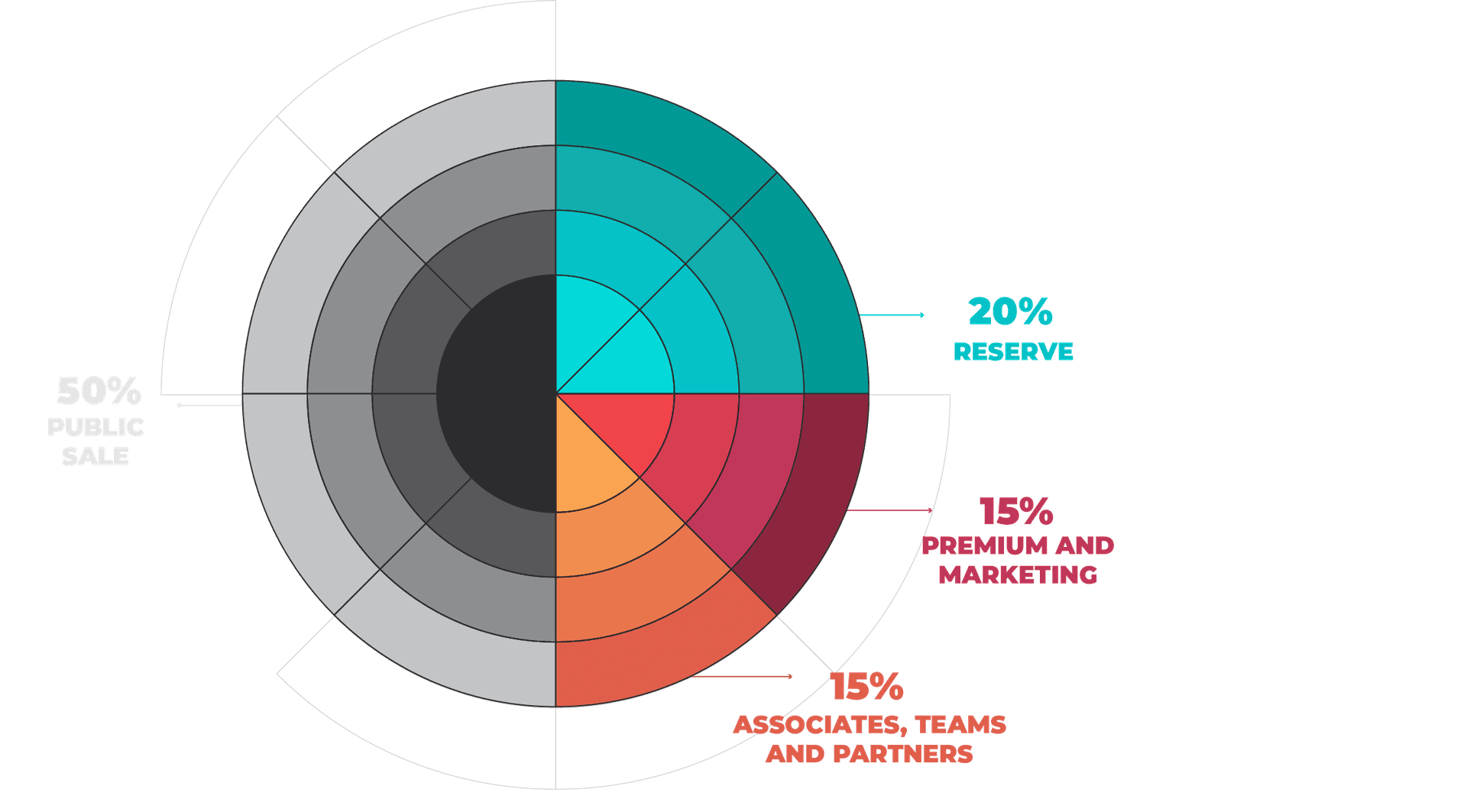

Let's take Bitcoin as an example. Its maximum quantity is set at 21 million units. No more Bitcoins will ever be created. This restriction on supply helps to maintain the value of the currency over time, an attractive feature from the point of view of preserving purchasing power. In our case, the maximum quantity of SWU issued is 300,000,000, while we burn large quantities of tokens each month (1M+), [confers annual burn plan] SWU is therefore a deflationary asset.

In this way, staking offers a dual opportunity: it allows investors to generate additional income while positioning themselves in an asset that is resistant to inflation. This can be a particularly attractive prospect for investors looking for innovative strategies with a long-term investment focus.

However, it should be borne in mind that staking, like any investment, involves risks, including the risk of losing the capital invested. It is therefore crucial to understand these risks and to diversify your investments to ensure optimum management of your investment portfolio.